| Victory International Futures |

|---|

| Daily Market Suggestion – 31 Januari 2025 |

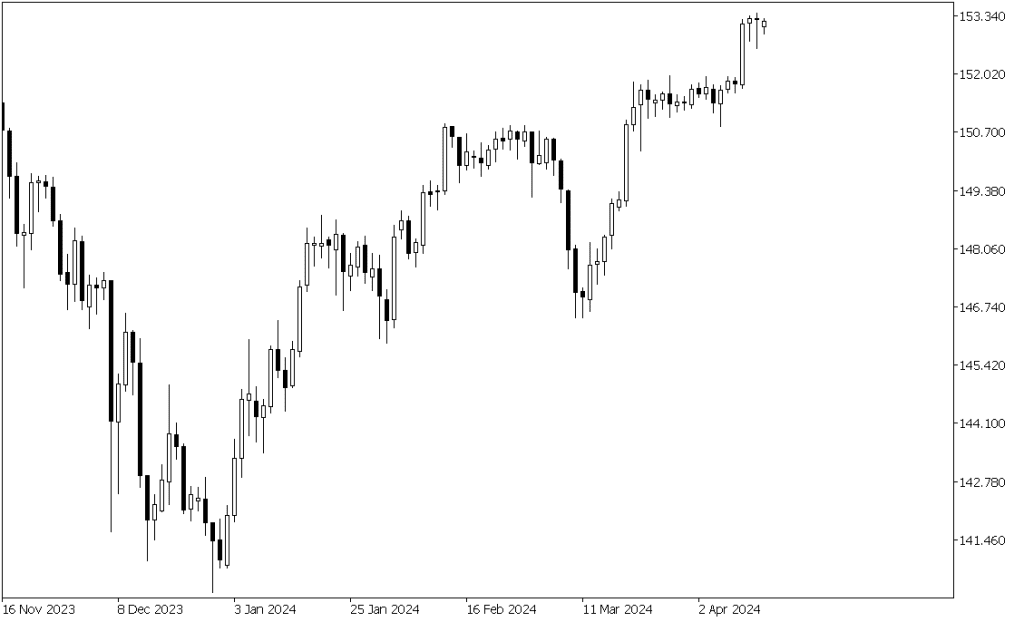

USDJPY

OHLC – DAILY

| THURSDAY | |

|---|---|

| Open | 155.250 |

| High | 155.263 |

| Low | 153.805 |

| Close | 154.290 |

ECONOMIC CALENDAR

| DAYS | CUR | WIB | REVIEW | FORECAST | PREV |

|---|---|---|---|---|---|

| FRIDAY | JPY | 06.30 | Tokyo Core CPI y/y | 2.5% | 2.4% |

JPY | 06.30 | Unemployment Rate | 2.5% | 2.5% | |

JPY | 06.50 | Prelim Industrial Production m/m | -0.1% | -2.2% | |

JPY | 06.50 | Retail Sales y/y | 3.4% | 2.8% | |

JPY | 12.00 | Housing Starts y/y | -3.7% | -1.8% | |

USD | 20.30 | Core PCE Price Index m/m | 0.2% | 0.1% | |

USD | 20.30 | Employment Cost Index q/q | 0.9% | 0.8% |

TRADING SUGGEST

| DAYS | BUY/SELL | TP | SL | |

|---|---|---|---|---|

| MONDAY | BUY | 155.600 | 156.100 | 155.100 |

| TUESDAY | SELL | 154.800 | 154.300 | 155.300 |

| WEDNESDAY | BUY | 155.600 | 156.100 | 155.100 |

| THUSDAY | SELL | 155.300 | 154.800 | 155.800 |

| FRIDAY | SELL | 154.500 | 154.000 | 155.000 |

SUPPORT – RESISTANCE

| RESISTANCE | R3 | 156.558 |

|---|---|---|

| R2 | 155.911 | |

| R1 | 155.100 | |

| PIVOT | 154.453 | |

| SUPPORT | S1 | 153.642 |

| S2 | 152.995 | |

| S3 | 152.184 |

MARKET RIVIEW

| ANALISIS | REVIEW |

|---|---|

| FUNDAMENTAL | Penembusan di Bawah 153,35 pada USD/JPY akan Menjadi Sinyal Bearish – Rabobank Selengkapnya di https://www.fxstreet-id.com/news/penembusan-di-bawah-153-35-pada-usd-jpy-akan-menjadi-sinyal-bearish-rabobank-202501301411?utm_source=telegram&utm_medium=channel&utm_campaign=-1001935086670 |

| TECHNICAL | Pada Time Frame D1, Stochastic Oscillator Cross Down, mengindikasikan harga Turun |

DISCLAIMER:

Analisis ini hanya sebuah informasi dan tidak ada keharusan untuk diikuti. Segala tindakan / keputusan yang anda ambil merupakan tanggung jawab penuh atas diri anda sendiri,