| Victory International Futures |

|---|

| Daily Market Suggestion – 15 Januari 2025 |

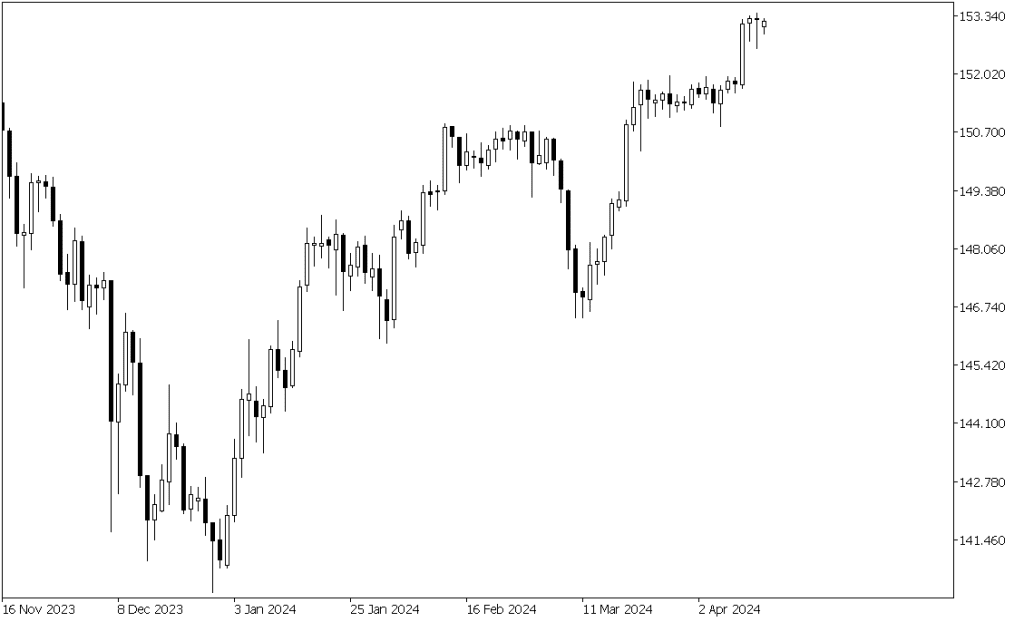

USDJPY

OHLC – DAILY

| TUESDAY | |

|---|---|

| Open | 157.533 |

| High | 158.212 |

| Low | 157.135 |

| Close | 158.003 |

ECONOMIC CALENDAR

| DAYS | CUR | WIB | REVIEW | FORECAST | PREV |

|---|---|---|---|---|---|

| WEDNESDAY | JPY | 06.50 | M2 Money Stock y/y | 1.2% | 1.2% |

JPY | 13.00 | Prelim Machine Tool Orders y/y | 3.0% | ||

USD | 20.30 | Core CPI m/m | 0.3% | 0.3% | |

USD | 20.30 | CPI m/m | 0.4% | 0.3% | |

USD | 20.30 | CPI y/y | 2.9% | 2.7% | |

USD | 20.30 | Empire State Manufacturing Index | 2.7 | 0.2 |

TRADING SUGGEST

| DAYS | BUY/SELL | TP | SL | |

|---|---|---|---|---|

| MONDAY | SELL | 157.800 | 157.300 | 158.300 |

| TUESDAY | BUY | 157.400 | 157.900 | 156.900 |

| WEDNESDAY | BUY | 157.900 | 158.400 | 157.400 |

| THUSDAY | ||||

| FRIDAY | ||||

SUPPORT – RESISTANCE

| RESISTANCE | R3 | 159.509 |

|---|---|---|

| R2 | 158.860 | |

| R1 | 158.432 | |

| PIVOT | 157.783 | |

| SUPPORT | S1 | 157.355 |

| S2 | 156.706 | |

| S3 | 156.278 |

MARKET RIVIEW

| ANALISIS | REVIEW |

|---|---|

| FUNDAMENTAL | Dolar Melemah karena Turunnya Imbal Hasil Obligasi AS Selengkapnya di https://vifx.co.id/dolar-melemah-karena-turunnya-imbal-hasil-obligasi-as/ |

| TECHNICAL | Pada Time Frame D1, Stochastic Oscillator Cross Up, mengindikasikan harga Naik |

DISCLAIMER:

Analisis ini hanya sebuah informasi dan tidak ada keharusan untuk diikuti. Segala tindakan / keputusan yang anda ambil merupakan tanggung jawab penuh atas diri anda sendiri,