| Victory International Futures |

|---|

| Daily Market Suggestion – 29 Januari 2026 |

OIL

OHLC – DAILY

| WEDNESDAY | |

|---|---|

| Open | 62.56 |

| High | 63.53 |

| Low | 62.05 |

| Close | 63.47 |

ECONOMIC CALENDAR

| DAYS | CUR | WIB | REVIEW | FORECAST | PREV |

|---|---|---|---|---|---|

THURSDAY | USD | 20.30 | Unemployment Claims | 206K | 200K |

USD | 20.30 | Revised Nonfarm Productivity q/q | 4.9% | 4.9% | |

USD | 20.30 | Revised Unit Labor Costs q/q | -1.9% | -1.9% | |

USD | 20.30 | Trade Balance | -43.4B | -29.4B | |

USD | 22.00 | Factory Orders m/m | 1.7% | -1.3% | |

USD | 22.00 | Final Wholesale Inventories m/m | 0.2% | 0.2% | |

USD | 22.30 | Natural Gas Storage | -237B | -120B |

TRADING SUGGEST

| DAYS | BUY/SELL | TP | SL | |

|---|---|---|---|---|

| MONDAY | SELL | 61.87 | 59.87 | 63.87 |

| TUESDAY | SELL | 61.30 | 59.30 | 63.30 |

| WEDNESDAY | BUY | 62.10 | 64.10 | 60.10 |

| THURSDAY | BUY | 63.00 | 65.00 | 61.00 |

| FRIDAY | ||||

SUPPORT – RESISTANCE

| RESISTANCE | R3 | 65.46 |

|---|---|---|

| R2 | 64.49 | |

| R1 | 63.98 | |

| PIVOT | 63.01 | |

| SUPPORT | S1 | 62.50 |

| S2 | 61.53 | |

| S3 | 61.02 |

MARKET RIVIEW

| ANALISIS | REVIEW |

|---|---|

| FUNDAMENTAL | Harga Minyak Bertahan di Level Tertinggi Empat Bulan Selengkapnya di https://investor.id/market/426424/harga-minyak-bertahan-di-level-tertinggi-empat-bulan |

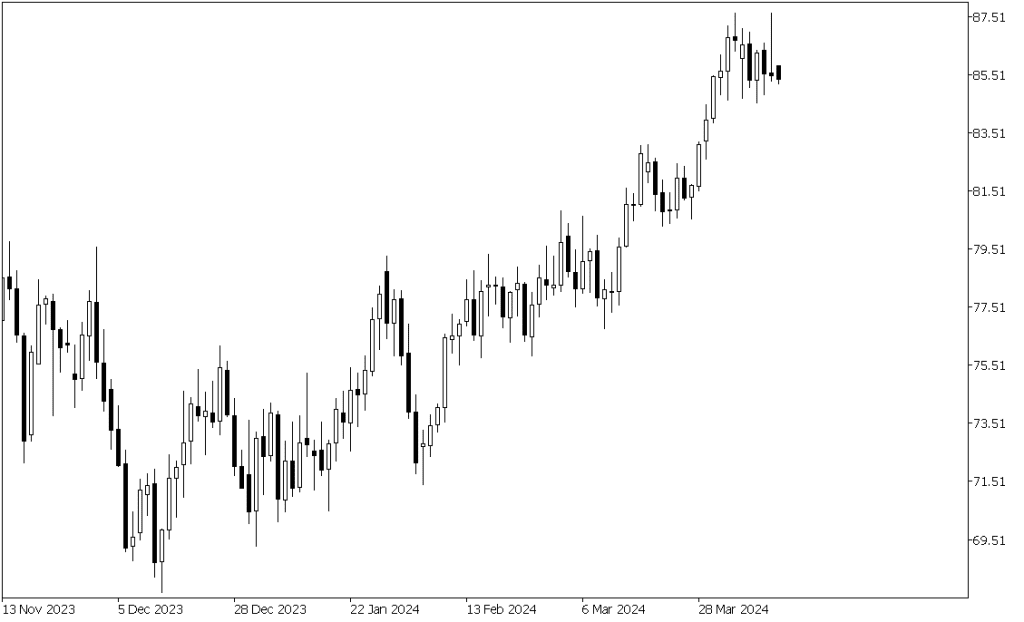

| TECHNICAL | Candlestick berada di atas MA100 interval H4 indikasi Bullish |

DISCLAIMER:

Analisis ini hanya sebuah informasi dan tidak ada keharusan untuk diikuti. Segala tindakan / keputusan yang anda ambil merupakan tanggung jawab penuh atas diri anda sendiri,