| Victory International Futures |

|---|

| Daily Market Suggestion – 9 Januari 2026 |

OIL

OHLC – DAILY

| THURSDAY | |

|---|---|

| Open | 56.40 |

| High | 58.71 |

| Low | 55.95 |

| Close | 58.38 |

ECONOMIC CALENDAR

| DAYS | CUR | WIB | REVIEW | FORECAST | PREV |

|---|---|---|---|---|---|

FRIDAY | USD | 20.30 | Average Hourly Earnings m/m | 0.3% | 0.1% |

USD | 20.30 | Non-Farm Employment Change | 66K | 64K | |

USD | 20.30 | Unemployment Rate | 4.5% | 4.6% | |

USD | 20.30 | Building Permits | 1.35M | ||

USD | 20.30 | Housing Starts | 1.33M | ||

USD | 22.00 | Prelim UoM Consumer Sentiment | 53.5 | 52.9 | |

USD | 22.00 | Prelim UoM Inflation Expectations | 4.2% |

TRADING SUGGEST

| DAYS | BUY/SELL | TP | SL | |

|---|---|---|---|---|

| MONDAY | BUY | 57.00 | 59.00 | 55.00 |

| TUESDAY | BUY | 57.70 | 59.70 | 55.70 |

| WEDNESDAY | SELL | 57.66 | 55.66 | 59.66 |

| THURSDAY | SELL | 56.78 | 54.78 | 58.78 |

| FRIDAY | BUY | 57.88 | 59.88 | 55.88 |

SUPPORT – RESISTANCE

| RESISTANCE | R3 | 61.53 |

|---|---|---|

| R2 | 60.12 | |

| R1 | 58.77 | |

| PIVOT | 57.36 | |

| SUPPORT | S1 | 56.01 |

| S2 | 54.60 | |

| S3 | 53.25 |

MARKET RIVIEW

| ANALISIS | REVIEW |

|---|---|

| FUNDAMENTAL | Harga Minyak Melonjak 3% Lebih Tinggi di Tengah Gejolak Venezuela dan Rusia https://internasional.kontan.co.id/news/harga-minyak-melonjak-3-lebih-tinggi-di-tengah-gejolak-venezuela-dan-rusia |

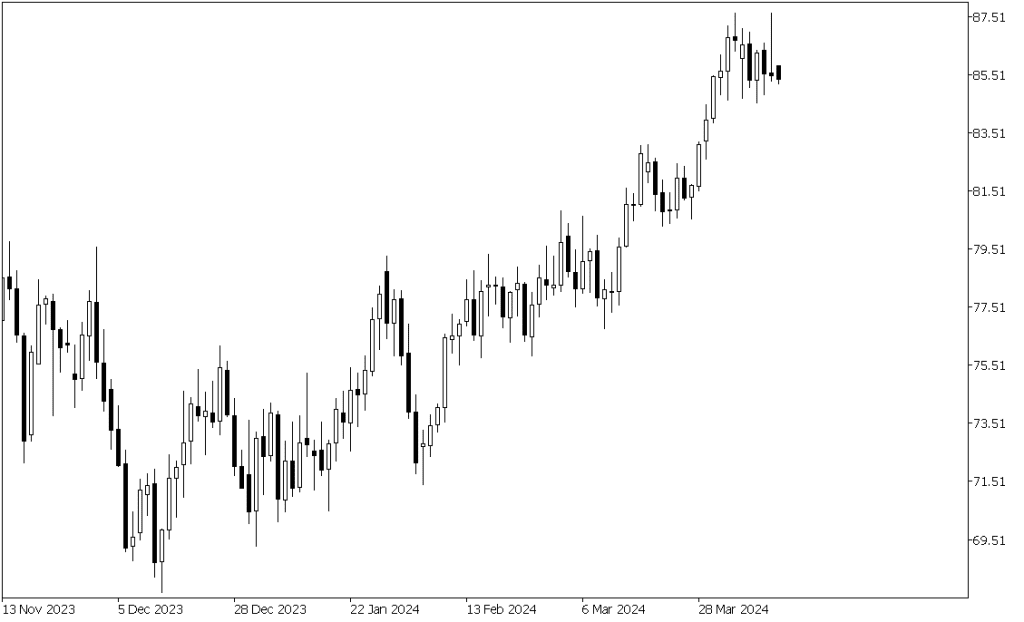

| TECHNICAL | Candlestick berada diatas MA50 interval H1 indikasi Bullish |

DISCLAIMER:

Analisis ini hanya sebuah informasi dan tidak ada keharusan untuk diikuti. Segala tindakan / keputusan yang anda ambil merupakan tanggung jawab penuh atas diri anda sendiri,